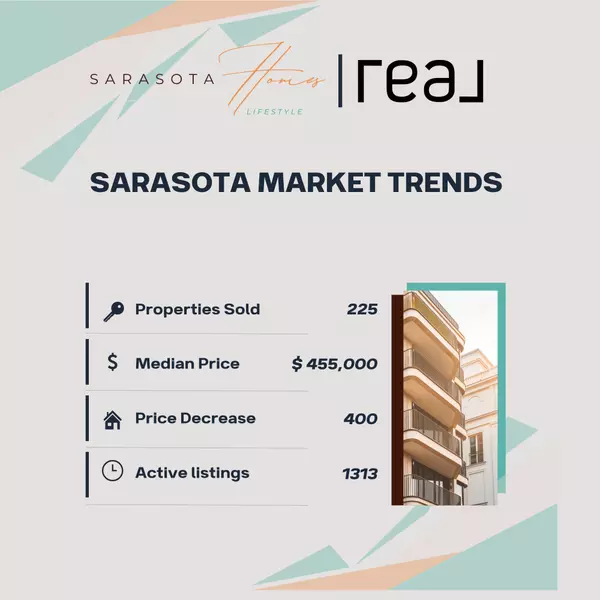

Market pulse – buyers get leverage

Buyers Call the Shots: Sarasota Prices Slide, Inventory Soars

-

Prices and inventory: The median sale price for single‑family homes in Sarasota County fell 8.1 percent year‑over‑year to about $455k, while Manatee County saw a 15.2 percent drop to $440k

. Inventory is soaring—Sarasota’s single‑family listings rose 23% and Manatee’s rose 27%. Homes are taking longer to sell (around 99 days in Sarasota), which means buyers have more choice and negotiating power.

-

List‑price discounts: Sellers are receiving about 92%–94% of their original list price. If you’re thinking about selling, pricing your home correctly is more important than ever.

-

Condo market: Condo and townhome prices are down as well; Sarasota’s median condo price dropped 3.2% to $371,750. Rising fees and stricter inspection rules have made buyers more cautious

From Peaks to Plateau: Where Sarasota Mortgage RatesAre Heading?

-

Current averages: Nationally, 30‑year fixed‑rate mortgages were around 6.72–6.86% during the last week of July, while 15‑year fixed rates averaged 5.85–5.89%. Florida’s average 30‑year rate fell in the 6.73–6.84% range—slightly below the national average.

-

Trend and forecast: Rates have remained below 7% for more than 25 weeks. Fannie Mae’s Economic and Strategic Research group expects them to ease to around 6.3% by the end of 2025. Realtor.com’s chief economist predicts rates will drift toward 6.4% later this yeart, but most experts caution that they’ll stay above 6 % until inflation and economic data improve.

-

What this means: Mortgage rates influence how far buyers’ dollars go and how quickly listings move. You could include a short table contrasting 30‑year and 15‑year rates, advise readers to shop around (since rates vary by lender and borrower profile), and remind them that lower rates may boost demand later this year, tightening the market again.

Categories

Recent Posts